Upon earning regular income for the first time, I wrestled with the idea that all I made was mine to spend. In part, this was due to the financial struggles my family was enduring, which created a sense of duty to contribute to monthly expenses. It also came from a culture that promoted remittances ‘back to the village’ or to caregivers by those in families who had moved to the city and made a life for themselves.

Following some research, I discovered the term black tax – broadly referring to financial support given to relatives or dependants on a regular basis, outside of their living expenses. The term originated from a racial dynamic imprinted in the apartheid history of South Africa.

Along racial lines, the apartheid government forced millions of South Africans out of economically productive areas, towards their so called ‘homelands’. As a result, migrant workers left their families in search of work elsewhere. Once found, they would send money and goods back to their rural households to support their impoverished relatives, creating a culture of remittance-dependence that still lingers in society several decades later.

Ubuntu or Burden?

Majority of these families were black. Today, the term ‘Black tax’ is used in communities of colour across the world to describe this system of remittance, with particular emphasis on the idea that the familial obligation imposes a ‘tax’ on one’s income.

From an African communalist standpoint, the idea of a Black tax is not too odd. Based on tradition, one could argue that it is simply one way that we contribute to the community of people that raised us, ensuring a cycle of progress – especially in families scarred by economic imbalance. This is inline with the ethic of Ubuntu, which envisions the identity of an individual as inseparable from his/her community and vice versa.

From a more western, individualist perspective however, interpretations of Black tax as a burden instead of a progressive tool would seem more fair.

Regardless, the history of black tax has seen it evolve to address the challenges of generational poverty and inequality across many African communities. Worldviews aside, the prevalence of ‘black taxes’, alongside other official redistributive mechanisms, is not a symptom of a well-functioning and equal society.

Restructuring Income Tax

Within the African context, there are calls for more inclusive tax systems that take into account the different levels of financial responsibility held by income earners.

‘Governments in many African countries fail their people by not using their taxes efficiently or appropriately to provide for people’s basic needs. Black tax then becomes a double tax on black professionals… they end up paying for the services that are supposedly provided for by government from the taxes they pay.’ – Zen Dyomfana, Investment manager, Investec.

For example, a recent study found that although the South African tax system provides tax credit for medical support, there are no provisions for deductions on private transfers to dependants or family. In fact, Section 23 (a) of the Income Tax Act explicitly prohibits deductions related to costs incurred in the ‘maintenance of the taxpayer, the taxpayer’s family or establishment.’

The study goes on to argue that with regards to restructuring income tax, inspiration can be drawn from the American tax system. Two provisions in particular, Section 151(c) & Section 222 of the US Tax Code provide conditional tax credit for those providing income support and those paying tertiary education tuition for related dependents.

Such provisions would be pivotal in the South African context, where many black South Africans bear more financial responsibility for the same amount of income than their white peers – owing in part to larger household sizes.

Basic Income Grant – More fundamental change

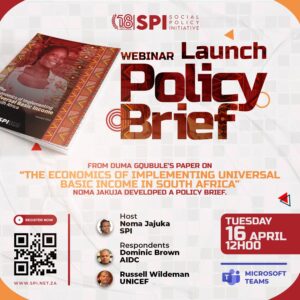

In a recent working paper, the Social Policy Initiative explores the alternative scenarios for financing a Basic Income Grant (BIG) in South Africa. The paper comes amidst calls for a radically transformative plan to reduce poverty and income inequality, and steer the economy away from its dystopian future. What would the implications of a BIG be for Black tax?

Intuitively, the more individual income people have, the less their dependence on family members to provide their livelihoods. In a sense, the institution of a BIG would shift the financial obligation implied by black tax from professionals in the black middle class, to the state.

‘The first (BIG) stimulus to the economy would cost 2.5% of a projected GDP of R21.8 trillion during the three year implementation period. If a household discovered that it would cost 2.5% of income to eliminate black tax, it would pay the money without batting an eyelid.’ – SPI

While the obligation may still remain on these professionals, perhaps in its cultural form, the necessity of a black tax would in many ways be alleviated by a Basic Income Grant. Research from pilot programs around the world has shown that the benefit of BIG’s extend beyond income assistance, also resulting in increased labour market participation, women empowerment and increased feelings of self-worth and dignity.

However, the enjoyment of these benefits is contingent on the method of financing chosen for a BIG. Attempts to finance a BIG through higher taxes would simply nationalise black tax, as opposed to eliminating it. As SPI rightly suggests, more alternatives should be explored to this end.

Conclusion

Given the current economic situation in South Africa, policy innovation is key to the alleviation of economic imbalance and its generational effects – as seen through the popularity of ‘black tax’. More effort must be placed in tax reform and discussions around new ideas like basic income support in order to achieve substantial and inclusive change for the nation at large.